McAllen car title loans offer quick cash advances for local residents, leveraging vehicle equity with minimal requirements and flexible payment plans. Ideal for those with poor credit or no history, but carries risks of repossession and debt cycles if not managed carefully. Community workshops empower residents with financial literacy to make informed decisions about these alternative lending options.

In the vibrant community of McAllen, a growing interest in alternative financing has led to an increase in car title loans. This article explores the intricacies of McAllen car title loans through two key lenses: understanding their complexities and navigating their potential benefits and risks. We also delve into the empowering role of community workshops in fostering financial literacy among residents, ensuring informed decisions regarding these short-term loans.

- Understanding McAllen Car Title Loans: A Comprehensive Guide

- Benefits and Risks: Weighing Your Options

- Community Workshops: Empowering Financial Literacy

Understanding McAllen Car Title Loans: A Comprehensive Guide

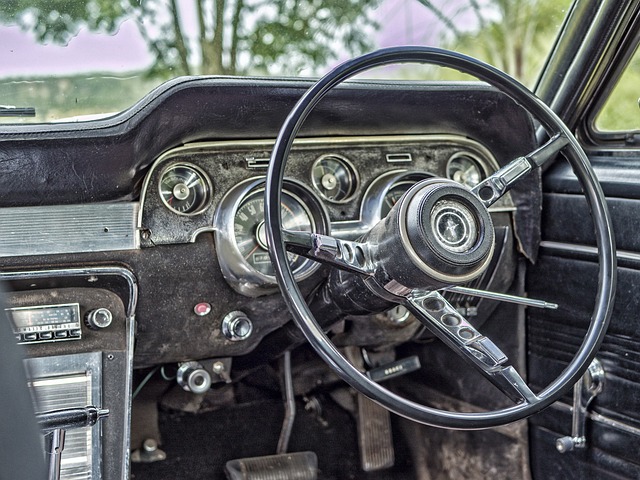

McAllen car title loans have gained popularity as a viable financial solution for many residents. This alternative lending method allows individuals to borrow money by using their vehicle’s equity, offering a quick and accessible option when traditional bank loans might be out of reach. The process involves providing the lender with your vehicle’s registration and title, and in return, you receive a cash advance, making it an attractive choice for those needing fast funding.

These loans are particularly beneficial for those with less-than-perfect credit or no credit history since they often do not require a thorough credit check. Lenders focus more on the value of your vehicle than on your financial past. Moreover, McAllen car title loans can be tailored to suit individual needs, with flexible payment plans and, in some cases, same-day funding, ensuring that borrowers receive their much-needed cash swiftly. This comprehensive guide aims to demystify this process, empowering residents to make informed decisions regarding their financial well-being.

Benefits and Risks: Weighing Your Options

Accessing McAllen car title loans can offer a quick solution for unexpected financial needs, providing fast cash to individuals who own their vehicles free and clear. This option is particularly appealing when dealing with urgent expenses or as a way to bridge a temporary gap in income. The process typically involves borrowing against the vehicle’s equity, allowing lenders to offer relatively higher loan amounts compared to traditional short-term financing options. However, it’s crucial to understand both the benefits and risks associated with this alternative lending method.

One significant advantage is the simplicity of qualifying for McAllen car title loans, as strict credit checks are often waived. This makes them an attractive option for individuals with poor or no credit history. Moreover, since the loan is secured by the vehicle, lenders may offer lower interest rates and more flexible repayment terms. However, there are risks to consider. If you fail to repay the loan according to the agreed-upon terms, lenders have the right to repossess your vehicle. Additionally, rolling over or extending the loan can lead to a cycle of debt, resulting in higher fees and potential loss of vehicle ownership if not managed carefully. Weighing these factors is essential when deciding whether McAllen car title loans are the best practice for managing your financial situation.

Community Workshops: Empowering Financial Literacy

Community workshops play a vital role in empowering financial literacy among residents of McAllen and surrounding areas. These educational sessions provide an opportunity for individuals to gain valuable insights into managing their finances effectively, especially when it comes to alternative lending options like McAllen car title loans. By attending these workshops, participants can learn about the intricacies of the title loan process, including how it differs from traditional banking methods.

The benefits of such initiatives extend beyond simply informing people about semi truck loans or title pawns. Workshops empower attendees with the knowledge to make informed decisions, ensuring they understand the terms and conditions associated with a title loan. This financial literacy is crucial, as it helps individuals navigate complex borrowing scenarios, avoid deceptive practices, and ultimately manage their debt responsibly.

McAllen car title loans can provide a much-needed financial boost, but understanding best practices is essential. By attending community workshops and gaining financial literacy, residents of McAllen can make informed decisions, navigate the process safely, and access the benefits of these loans while mitigating associated risks. These workshops empower individuals to take control of their financial future.