McAllen car title loans operate within a regulated environment focusing on consumer protection and fair practices. Lenders emphasize transparency in communication, interest rates, and fees while utilizing marketing strategies to highlight fast access and lenient credit checks. Recent guideline revisions streamline processes like refinancing and debt consolidation, fostering a mutually beneficial environment for borrowers seeking flexible financing options, including McAllen car title loans and title pawn services.

McAllen car title loans have become a significant financial option for many residents. With recent changes in advertising guidelines under review, understanding the regulations is crucial for both lenders and borrowers. This article delves into the intricacies of McAllen car title loan advertising best practices, outlining key points for lenders to navigate this competitive market effectively. By staying informed about recent guideline revisions, businesses can ensure compliance while reaching a wider audience seeking efficient financing solutions.

- Understanding McAllen Car Title Loans Regulations

- Advertising Best Practices for McAllen Car Loan Lenders

- Recent Changes: Reviewing McAllen's Car Title Loan Guidelines

Understanding McAllen Car Title Loans Regulations

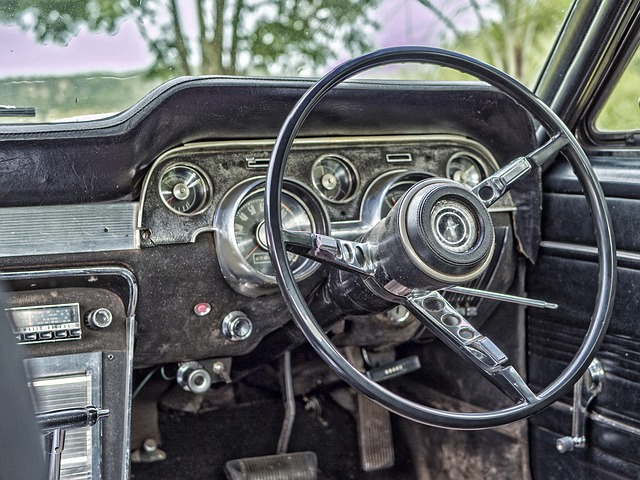

In the competitive world of McAllen car title loans, understanding and adhering to local regulations is paramount for lenders and borrowers alike. These guidelines play a crucial role in ensuring fair practices and protecting consumer rights within the loan industry. One key aspect involves meticulous Vehicle Valuation processes, where lenders assess the worth of the vehicle presented as collateral. This step is essential to determine loan amounts and safeguard both parties from potential financial risks.

Moreover, the regulations emphasize the importance of transparent communication regarding interest rates, repayment terms, and any associated fees. Borrowers should be well-informed about their Vehicle Ownership rights and responsibilities throughout the loan period. By adhering to these McAllen car title loans advertising guidelines, lenders can foster trust and build a robust framework for accessing semi truck loans or other vehicle-backed financing options.

Advertising Best Practices for McAllen Car Loan Lenders

In the competitive landscape of McAllen car title loans, advertising plays a pivotal role in attracting potential borrowers. Lenders should focus on creating clear and transparent ad campaigns that highlight the benefits of their services. Emphasizing fast cash availability and minimal credit check requirements can be effective strategies to reach out to a wider audience. Using compelling visuals and straightforward messaging can help lenders stand out while adhering to legal guidelines.

Additionally, showcasing competitive interest rates and flexible repayment terms can differentiate McAllen car loan lenders from their peers. Incorporating success stories or positive customer testimonials could add credibility to the advertisements. Given the popularity of Houston title loans among borrowers, strategic comparisons or references to these products might indirectly enhance the visibility of McAllen car title loans while targeting a similar demographic.

Recent Changes: Reviewing McAllen's Car Title Loan Guidelines

Recent changes in McAllen’s Car Title Loan guidelines have sparked a wave of interest and discussions within the financial community. The city is reevaluating its regulations to ensure they align with modern lending practices, catering to the growing demand for flexible financing options. With McAllen car title loans becoming an increasingly popular solution for individuals seeking quick cash, these updates are timely.

The review focuses on streamlining processes like loan refinancing and debt consolidation, offering potential borrowers easier access to capital. By revising the guidelines, McAllen aims to create a more transparent and beneficial environment for both lenders and borrowers, particularly those considering alternative financing methods such as title pawn services.

The recent review of McAllen car title loan guidelines signals a commitment to ensuring transparent and fair advertising practices within the industry. By implementing stricter regulations, McAllen aims to protect consumers from deceptive marketing strategies and promote responsible borrowing. Lenders are now encouraged to adhere to best practices, fostering a more ethical landscape for McAllen car title loans and enhancing trust among prospective borrowers.